A bill of exchange is defined as follows:

An unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a certain sum in money to (or to the order of) a specified person or to bearer.

To better understand the above definition of bill of exchange, the following points should be kept in mind:

Bearing no condition means that there is no condition attached to the bill.

A bill of exchange is an order to pay certain money. It is not a request.

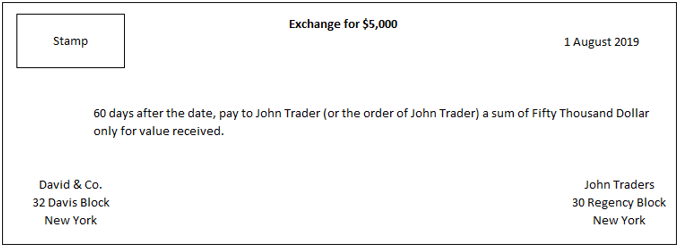

The person who makes (i.e., writes) the bill is the person who orders to pay the amount of the bill. This individual is called the drawer.

The person upon whom the bill is drawn or the person to whom the order is given is known as the drawee. This individual accepts the bill by writing the word "Accepted" across the face of the bill and signing it.

The bill is payable whenever the amount of the bill is demanded (only in the case of sight bill).

A clear and certain time in the future (e.g., 10 December 2019).

A future time that can easily be determinable (e.g., 90 days after the date of drawing the bill).

The amount is payable in the form of money rather than a commodity or any other means. For example, a sum of $10,000 in money.

The payee is the person to whom the amount of the bill is paid.

The amount of the bill can be paid to the drawer, or to someone else, as per the order of the drawer or to the person who presents the bill on the due date.

This is why definition contains the phrase" to or to the order of a specified person or to bearer."

In this modern age of competition, credit selling is an evil that every businessperson has to engage in. This is because credit sales are one of the strongest tools to enhance net income.

The refusal to give credit means that competitors may win potential sales. However, no businessperson wants to sell goods on credit to customers who may not pay their debts.

Firstly, remember that businesspeople always seek to promote sales and, alongside this, to secure money and customers.

A seller wants to realize the amount of goods sold as soon as possible, maximizing the goods sold and minimizing the chance of bad debts can be minimized.

In contrast to a seller, a buyer wants to get maximum credit period. Is there any method that satisfies both the parties? The answer is yes.

There is a payment method, known as bill of exchange, that provides the seller with evidence of amount receivables as well as the amount of goods sold. Noteworthily, this method also offers a sufficient credit period to the buyer.

The bill of exchange method of payment has several advantages compared to other methods.

There are three main parties involved in a bill of exchange: drawer, drawee, and payee.

The drawer is the maker of the bill. They draw or writes the bill and they sign the bill. Although a bill can be accepted before receiving the drawer's signature, their signature is required to complete the document.

The drawee is the person upon whom a bill of exchange is drawn, or the drawee is the person who accepts the bill and promises to pay the amount. When the drawee accepts the bill, he becomes the acceptor.

The payee is the person who is named in the instrument as the individual who the amount of the bill should be directed toward to be paid. As such, the payee is the person who receives the amount of the bill.

The payee may be the drawer or someone else. If the drawer keeps the bill with themselves until the due date and receives the amount of the bill, then the drawer and payee are the same person.

There are also other parties involved in a bill of exchange, including:

The holder of a bill of exchange is the person who is entitled in their own name to the possession of the instrument and to receive the amount due thereon.

It is not only possession but also entitlement to possession that makes a person the holder of the bill. Thus, a person in possession of a stolen or lost bill cannot be a holder.

Any person who, for consideration, becomes the possessor of a bill payable to the bearer is known as the holder in due course. Amy person who has received the bill from the previous holder is called a holder in due course.

Sometimes, in bills of exchange, the name of a third person is mentioned. If the original drawee does not accept or pay the bill, then this third person will accept and pay the bill. This third person is known as the drawee in case of need.

If the original drawee refuses the bill and the holder of the bill gets the bill noted and protested due to non-acceptance, then any person who is not already liable to accept the bill may accept the bill with the consent of the holder.

This person is known as the acceptor for honor.

A bill of exchange can be classified based on the following three bases:

A bill with no fixed payment date. It is payable at the time when it is presented by the holder. Days of grace are not allowed on a bill of this kind. A demand bill is also known as a sight bill.

A bill drawn for a specific time period. This type of bill has either a fixed future date or determinable future time.

A bill drawn and accepted due to the sale and purchase of goods on credit. This type of bill is drawn by the creditor (seller) and accepted by the debtor (buyer).

A bill drawn and accepted without the sale and purchase of goods. The main purpose of this bill is to provide financial assistance to one or both parties. The bill does not come into existence due to any trading activity.

A bill drawn, accepted, and payable in the same country. Both the drawer and acceptor of this bill live in the same country.

A bill drawn in one country and accepted and payable in another country. Both the drawer and drawee of this bill live in two different countries.

The drawee is not liable to pay the bill until they accept the bill. Therefore, the drawee's acceptance of the bill of exchange is necessary to complete the instrument.

The act of signing and writing the words "Accepted" across the face of the bill by the drawee is called acceptance. The advantage of acceptance is that it fixes the liability on the drawee.

Acceptance is of the following two kinds:

If the bill of exchange is accepted without any condition to the order of the drawer, the acceptance is termed as general acceptance.

When a bill of exchange is accepted with any qualification or condition to the order of the drawer, the acceptance is known as qualified acceptance.

Qualified acceptance is separated into the following types:

The time period after which a bill of exchange is matured is called the "tenor" of the bill.

For example, if a 90-day bill is drawn and accepted, the bill will be matured after 90 days. So, the tenor of this bill is 90 days.

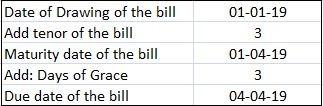

In the business community, when the due date of a bill is calculated, it is customary that after maturity of the bill, three extra days are given to the drawee for the payment of the bill. These extra days are called days of grace.

Usance refers to the period of time for the payment of the bill which is fixed by the tradition of the market.

For example, consider a 90-day bill that will be matured after 90 days. Therefore, tenor of the bill is 90 days.

However, three extra days will be given to the drawee for payment of the bill. Here, the usance of the bill is 93 days.

A term bill matures when its tenor expires. Therefore, maturity of the term bill may be defined as the end of the tenor of bill.

The date after the tenor ends is called the date of maturity, whereas the date at which the term bill becomes payable by the drawee is called the due date of the term bill.

A bill becomes payable by the drawee after the days of grace.

For example, suppose a bill is drawn on 1 January 2019 for three months. Its date of maturity and due date are shown as follows:

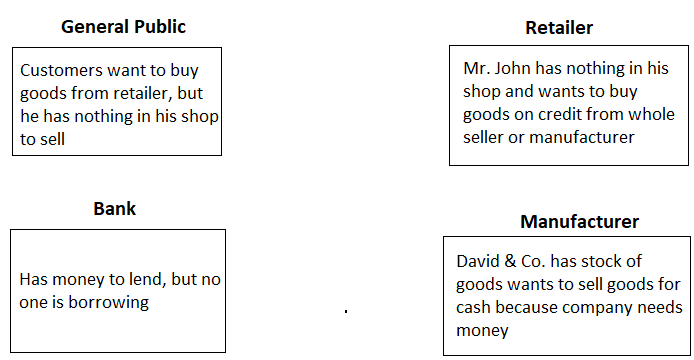

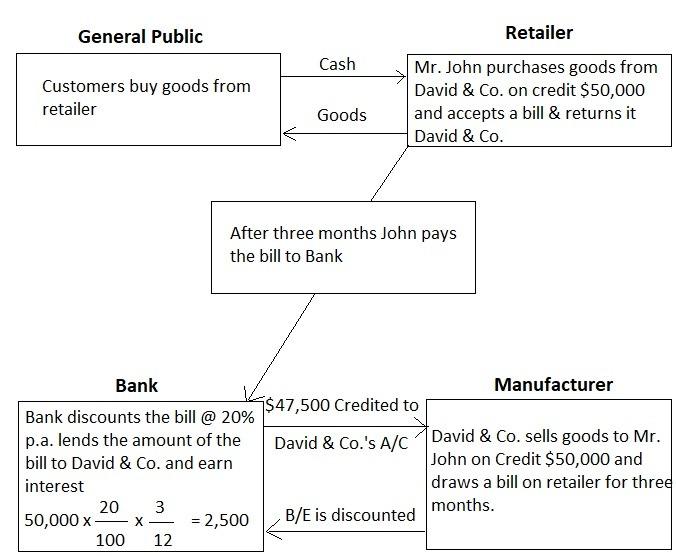

How does a bill of exchange work? Let's explain this with the help of a few examples.

The situation shown in the figure above can be understood using the following notes:

Now you will see how a bill of exchange helps to promote business activities.

The following points are noteworthy in relation to this figure:

This example shows how a bill of exchange helps to promote business activities.

The use of bills of exchange as a method of payment has several advantages compared to other methods of payment for the credit sale of goods. Some of these advantages are the following:

1. Legal evidence

A bill of exchange is a legal document; therefore, it is a legal evidence of the debt. As such, the drawer can sue for the recovery of the amount of the bill.

2. Specific amount and date

A bill of exchange is signed by both parties. For this reason, both parties are aware of the amount of the bill and its due date.

3. Discounting facility

Another advantage of a bill of exchange is that it can be discounted if the drawer or holder needs funds before the due date. The bill can be sold to the bank to receive the total amount in advance.

4. Negotiable

Negotiable means transferable. A bill of exchange payable to the bearer can be transferred by one person to another for the settlement of debt.

5. Drawee enjoys full credit period

The drawee is bound to pay the amount of the bill on the due date. They cannot be compelled to make the payment earlier. Therefore, the drawee enjoys the full credit period.

6. Change in relationship

Before a bill of exchange, the seller is a creditor and the buyer is a debtor. The bill of exchange converts this relationship into "drawer" and "drawee".

7. Easy remittance

As bill of exchange is a negotiable instrument, just like a postdated cheque. Therefore, it can easily be remitted from one place to another, just like a cheque.

Earlier, it was mentioned that creditors (sellers) can draw a bill of exchange and become drawers. Since the amount of the bill is receivable by the drawer, the bill of exchange, from this point of view, is called the bill receivable.

On the other hand, the debtor (buyer) accepts the same bill and becomes the drawee. The amount of the bill is payable by the drawee, and so from the drawee's point of view, the bill of exchange is known as the bill payable.

To send money or goods to someone else through somebody called as "collector". This person will receive the money or goods and deliver it to the intended person. The collector usually charges a fee which is called 'commission'.

A Bill Of Exchange is an unconditional order in writing, addressed by one person (the drawer) to another (the drawee), signed by the drawer, requiring the drawee to pay on demand a certain sum in money to, or to the order of, a certain person (the payee). All bills of exchange must contain a definite date on which they become due.

A bill first comes into existence when it is signed by the drawer and accepted by the drawee.

The main difference between a bill and a cheque is that a Bill Of Exchange is not payable on demand, whereas a cheque is. A bill becomes payable at some future date which is fixed when the bill is drawn, whilst a cheque is payable at once. A cheque must always be signed by the drawer, whereas a bill may be signed by the drawer or by someone else on the drawer's behalf. Bills are also more formal than cheques and are used for transactions which involve larger sums of money.

A bill becomes payable at the maturity date, which is always specified on the bill. A Bill Of Exchange which becomes payable on a certain day is known as a 'dated' or 'specific' bill. Bills may also become payable after a certain period following the date of the bill has elapsed, known as an 'open' or 'uncertain' bill.

About the Author

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Content sponsored by 11 Financial LLC. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from 11 Financial upon written request.

11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

© 2024 Finance Strategists. All rights reserved.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.